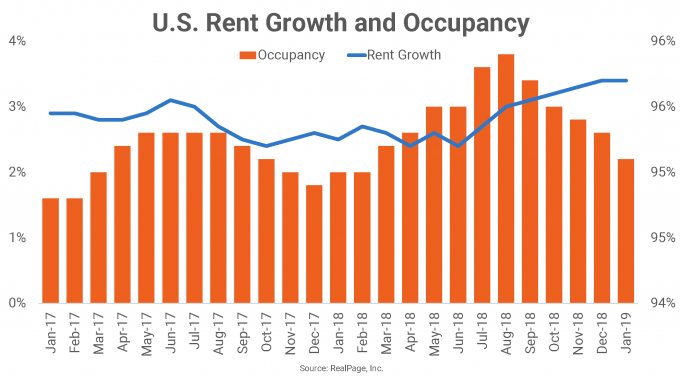

January fundamentals for the nation’s multifamily market continue to look favorable for owners and operators. Rent growth continues to strengthen as occupancy in the market remains very tight.

Average effective rent growth is up 90 basis points (bps) year-over-year to stand at 3.4% nationwide in January. The nationwide rent growth rate hasn’t been this high since August 2016. After hovering below the 3% threshold between mid-2017 and mid-2018, rent growth hit 3% in August 2018 and has been steadily climbing every month since.

Occupancy nationwide has been softening since August but is still up 20 bps year-over-year to stand at 95.1% in January. Occupancy tends to be lower in the colder months, so it’s not surprising that January’s rate has eased from the summer months. January 2019’s occupancy of 95.1% is the highest January rate the U.S. has seen during this economic cycle.

The ranking of top rent growth performers for year-ending January 2019 has many familiar names that have remained high on this list for several months – such as Phoenix, Las Vegas and Atlanta – as well as some newcomers, such as Sacramento. Austin’s 530 bps growth represents the largest year-over-year momentum shift among major markets in the nation.

None of the nation’s largest 50 markets saw negative rent change in year-ending January. The slowest-growing market, Houston, is seeing rents climb a mere 0.2% annually, but slowing growth has been the case in that market for the last four months or so.

Other laggards include Cleveland with 1.3% rent growth and Kansas City, Anaheim and New York, each with 1.8% rent growth.

Across the nation, about 390,000 apartment units are under construction with about 328,000 projected to complete in the next 12 months. That number is elevated from the previous 12 months when about 267,000 units were completed. In the last year, demand has well outpaced supply, as about 283,000 units were absorbed nationwide.

Dallas, Los Angeles and Washington, DC take the top three spots for the number of units set to complete in the next year. About 23,000 units are scheduled for delivery in Dallas, while 17,500 units and 15,400 units are scheduled for LA and DC, respectively.

However, when looking at scheduled new inventory as a percent of existing stock, Charlotte, Seattle and Dallas take the top spots with 4.1%, 3.9% and 3.8% growth, respectively.