[Source Images: Michael Burrell/iStock, Mike_Kiev/iStock]

For most Americans, health coverage is tied to their employment. That means millions of people are uninsured or underinsured—especially during a pandemic that has seen 6 million people directly lose their employer-based coverage. What if you could access a healthcare plan through something else, like your housing? For residents who live in a property owned by Comunidad Partners, that’s now an option.

Comunidad Partners is a real estate investment firm that buys apartment communities, renovates them, and manages them. Comunidad is for-profit, but mission-based. It works in tandem with a nonprofit called Veritas Impact Partners, cofounded by Comunidad managing partner Antonio Marquez, to provide services to its tenants. Together, Comunidad and Veritas brought a virtual healthcare program to Comunidad’s residents.

“We’re always focused on health and wellness, but in the wake of COVID-19, the health and wellness that we would do before, which is focused on diabetes testing, we do dental checkups for kids—this is all in-person, human interaction, and we could no longer do that,” says Marquez. “We needed to pivot and find a virtual way to engage with residents to fulfill our mission of health and wellness.”

Comunidad and Veritas partnered with a Fortune 500 healthcare provider—they won’t reveal who, but Marquez says it’s a household name—for a telehealth contract. This company provides virtual health care to employers, and Comunidad asked that they tailor a program for multifamily communities. Those residents can connect with a doctor or nurse practitioner via an app to be diagnosed or prescribed treatment virtually; the care covers both physical and mental health, and is completely free to residents, and will be available indefinitely, not just during the pandemic.

This housing-provided healthcare became available to Comunidad residents in May 2020, and it’s currently implemented across 2,000 households, impacting more than 6,000 people. That’s about half of Comunidad’s portfolio; Marquez hopes to get it to 100% soon, and says the firm is working on outreach to help residents download and register for the corresponding app. Because the initiative was spearheaded through the nonprofit, Veritas can work with other companies that manage affordable housing properties to bring virtual health care to even more renters. Comunidad Partners hopes it can reach 20,000 households and 60,000 residents in three to five years.

Marquez says this is one of the first instances where families can get free telehealth through a real estate owner-operator, meaning people don’t have to rely on a job to have healthcare coverage. He’s not worried that this will mean residents won’t work or be able to pay their rent, though. If a resident does lose their job, they’ll still have healthcare, and Marques says that Comunidad has programs to help them build their résumé, get trained on vocational skills, or even be connected to a job opportunity.

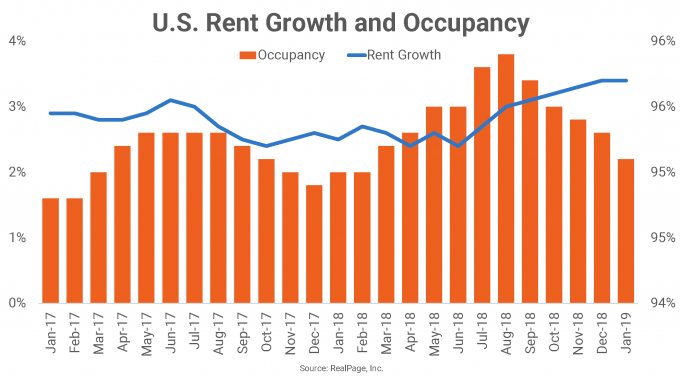

Marquez says the plan isn’t just about generosity, it also makes business sense. “If you have happier residents, they’re going to live in your property a longer time, and if you have resident retention then your occupancies are higher, operating costs are lower, your turnover costs are lower, and your bottom line is just as healthy—if not healthier,” he says. “Even if somebody’s skeptical about social impact, if they’re only profit driven, then look at this as a strategic imperative as well, so you can do right by your residents but there also is some economic incentive around it.”

Since offering telehealth, Marquez says he’s heard that residents are renewing their leases specifically because they have this option to get healthcare through their housing. “Employment is not a prerequisite to health, and it shouldn’t be. Health and wellness should be an inalienable right,” he says. “It’s not a political statement, it’s just a humanity statement. Frankly we think it’s our obligation to do a little bit more.”

![[Source Images: Michael Burrell/iStock, Mike_Kiev/iStock]](https://images.squarespace-cdn.com/content/v1/5c366a38f2e6b11b6fe04d0d/1615914677738-DISNQ0X37DGSFU4N0F16/Screen+Shot+2021-03-16+at+1.10.09+PM.png)